Time reporter proves financial illiteracy is the pathway to the journo class

Senior National correspondent Charlotte Alter holds the argument is over who paid more rather than why

A common refrain of supporters of student loan forgiveness has been that those grumbling about wiping away the debts are often middle aged and elderly politicians that benefited from much more affordable tuition prices when they went to school. Therefore, the logic holds, they are incapable of understanding the financial plight of millennial and Gen. Z students and graduates that feel like they are on a hamster wheel.

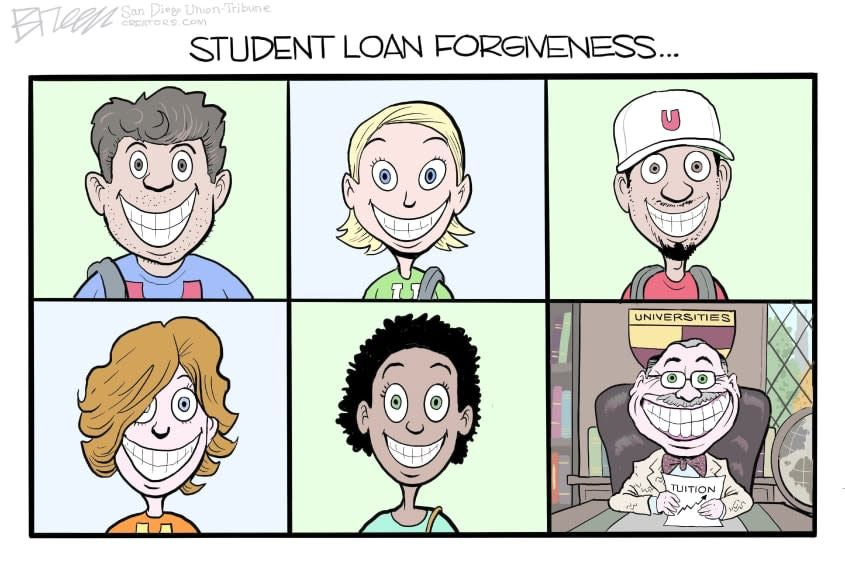

Time's Charlotte Alter recently stated this position in an article that took to task several elected officials of both parties for their comments on Pres. Biden's current program to cancel $10,000 in student loans for those earning under $125,000, or $20,000 in the case that they qualified for low-income undergraduate students. But Alter's argument is typical of the reporter that shows up yelling hysterically at the scene of an erupting volcano without actually discussing how and why the disaster is occurring.

Spare me a dime?

Comparing the cost of a college education in previous decades to today's would be just as absurd as picking the price of any other service or commodity. Have you ever heard from your grandpa the story of how he could go to the ballpark for a baseball doubleheader and get hot dogs for himself and his sister, all for a quarter? Maybe he was exaggerating, but it's certainly true that the nominal price of a ticket was $2.25 in 1950 and reached $17.85 in 2002.

I'm not claiming that college tuition and baseball tickets are an apples-to-apples comparison. But the concept is the same: A quality experience that was previously sold cheaply underwent decades of rising labour costs, sprawling and wasteful infrastructure upgrades, and near-sighted subsidies that allowed the people managing it to hike the price over-and-over again under the guise of remaining competitive and maintaining quality. The actual causes of the massive tuition inflation are borne out of terrible educational policy, and a decision to "forgive" any of the debt will only aggravate the problem.

Insert more to play again

It should surprise no one that one of the reasons that tuition has gone up and therefore student loan debt has gone up is the availability of the loans to begin with. One of the first public figures to warn about the availability of student loans and how that could lead to runaway student debt was William Bennett, Secretary of Education under President Ronald Reagan. Part of the problem is that attending college before WWII was a rare privilege only available to the wealthy or unusually gifted student, whereas today enrollment hurdles are easily cleared for any student background. And while this may have made education more egalitarian and accessible for those that are less fortunate, the effect on the schools themselves has been to generate explosive and unsustainable growth.

To put this into perspective, in 1947 there were 2.4 million Americans enrolled in college, undergraduate and graduate students combined. This number soared to a peak of 21 million in 2010 before settling since then around 19 million. That is an increase of 875%, outpacing the growth of the general American population which incre-ased by 230% over the same period. In tandem with this has been the rise of average cost of 4-year college tuition from $243 public/$1,011 private in 1963-64 to $9,349 public/$32,769 private in 2019-20. The most consequential event of this period was the passage of the 1965 Higher Education Act, after which the annual cost of tuition began to swell. Since then, the average increase in tuition costs has been 6.8% annually.

The connection between rising borrowing and tuition costs is also made by the National Bureau of Economic Research (NBER), a premier non-profit think tank in a 2016 report: “Looking at individual factors, we find that expansions in borrowing limits drive 40% of the tuition jump and represent the single most important factor. . . Second, the re-authorization of the Higher Education Act in 1992 introduced a major change along the extensive margin by establishing an unsubsidized loan program. We also find that increased grant aid contributes 17% to the rise in tuition, which mirrors the 18% impact of the higher college earnings premium.”

Beggars can’t be gougers

Alter also alleges that the rise in tuition rates is a result of funding cuts at the state level during the 1980s and 90s. This PBS article also agrees, claiming that it has caused average tuition rates to increase by almost $2,000 between 2014 and 2019. But that explanation would require that colleges and universities are struggling to make ends meet and deeply dependent on public funding. But that just isn’t happening. If anything colleges that strategize and structure their endowments from private philanthropy have grown rich enough that they could rival multinational corporations. The National Association of College and University Business Officers (NACUBO) issues yearly lists of endowments. They show that for the 734 largest endowment funds all balances grew between 2020 and 2021.

Windfalls in this sector attracted the attention of Forbes in 2021, and the growth of US college endowments attracted the envy of the British in 2014 where such success had eluded them since the 2008 Recession. In 2013, which is covered by the period that Alter is referring to, it was reported in The Atlantic that the US was tied with South Korea for most postsecondary spending as a percentage of its GDP, but lagged near the bottom for degrees earned per unit spending, of 20 countries examined in a Georgetown University study. The claim that colleges and universities hike tuition rates because of a lack of state funding does not hold water, and actually works to shield the higher education industry’s own financial greed, including paying one third of adjunct faculty less than $25,000 per year and another third less between $25,000 and $50,000 per year. This is an especially sore topic in a time when college presidents are paid extravagant six or even seven figure salaries and and often enjoy bonuses and other perks. In almost every fashion being the head of a higher ed institution is on par with and often in the same career path as a corporate CEO.

The world classroom

Coupled with the massive endowments, often donated by major corporations and rich alumni, higher education institutions have found foreign students to be a reliable source of revenue. In 2019 the Institute for International Education reported that the number of international college students reached an all-time high, totaling almost 1.1 million, or 5.5% of the total university population. Of these, more than 369 thousand came from China and more than 200 thousand from India. Many of these students graduate and go on to thrive at home as professionals or remain in the USA and succeed there. This comes with a catch however, as international students are alleged to cheat on exams and other coursework at a rate 5.1% of their domestic counterparts. According to the Wall Street Journal investigation into this phenomenon, the issue of disciplining these students often conflicts with the advantage of accepting their tuition payments that may be double or more that of domestic students if they are part of a state subsidized program from their home country.

Goals unfulfilled lead to debts unpaid

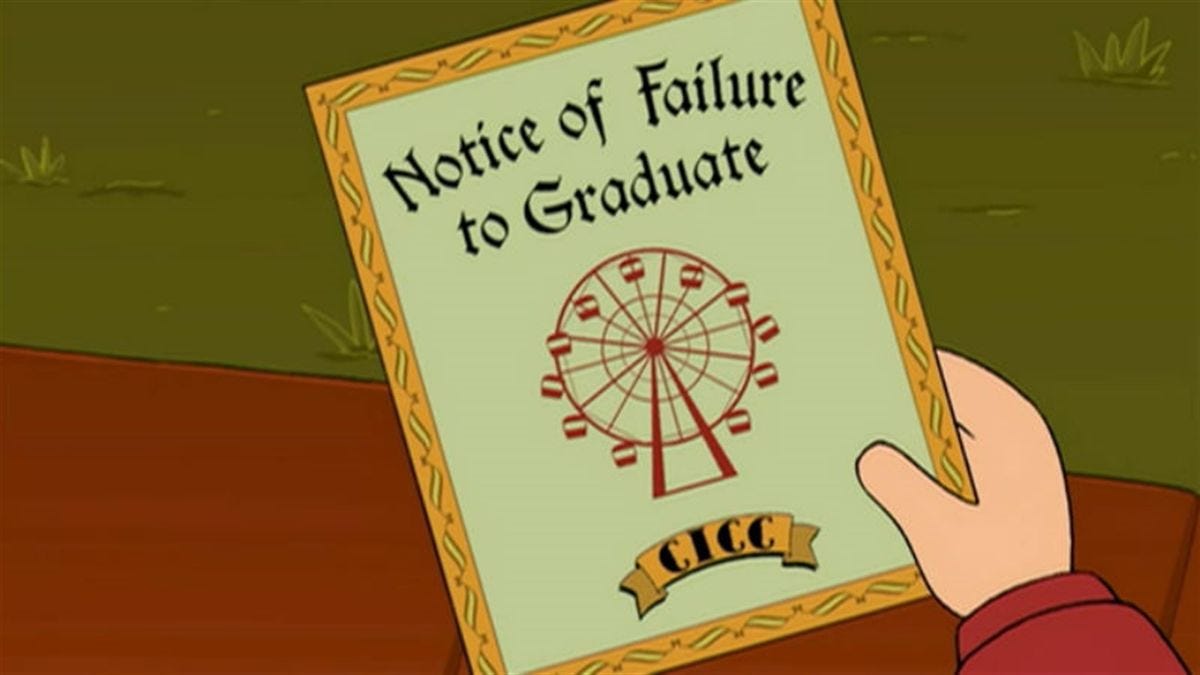

One final question on the issue that goes completely unaddressed by Alter is: What happens to the debt of the students that do not graduate from college? Unsurprisingly the answer is that loans that graduates struggle to repay even if they are able to enter the workforce with a high paying job are an even more difficult burden for drop-outs. In 2018 Michael Itzkowitz of the center left-leaning Third Way think tank published a report showing after five years only 68% of college graduates had made progress on paying down their loan principal. But only 43% of non-graduates (drop-outs) had made any progress.

According to Forbes after six years less than 60% of those enrolled at a four year institution will have graduated with a 4-year degree. College dropout rates have spiked during COVID, but even before that there was an average 12-month dropout rate around 25% for full-time freshmen undergraduates between 2015 and 2020, and more than 50% for part-time freshmen.

This discussion like many others doesn’t deserve to be political; it just simply is. In many speeches over his career President Biden and First Lady Jill Biden have called a college education “the pathway to the middle class”. Instead it’s become the highway to debt ridden hell and poverty thanks to decades of bipartisan policies on student loans and subsidies. Many have stepped forward to call out the flawed logic that holds student debt “cancellation” to be a solution. Charlotte Alter’s flawed article complaining about how college cost less when Chuck Grassley graduated in the 1950s shows how many of its advocates are too lazy to even look at the cause of the problem.